EOA vs SCA: Comparing the Approaches to Chain Abstraction

In the bustling world of blockchain, a quiet revolution is brewing. It's called chain abstraction and promises to make blockchain interactions as seamless as sending an email. But as with any revolution, there are competing factions, each with its vision of the future. In one corner, we have the stalwart Externally Owned Accounts (EOAs). On the other hand, the upstart Smart Contract Accounts (SCAs).

The Battlefield: Chain Abstraction

Let's set the stage before we dive into this clash of titans. Chain abstraction is all about making blockchain networks play nice with each other. Imagine being able to hop between Ethereum, Solana, and Bitcoin without even realizing you've crossed a border. That's the dream.

But how do we get there? That's where our contenders come in.

- The Reigning Champion: Externally Owned Accounts (EOAs)

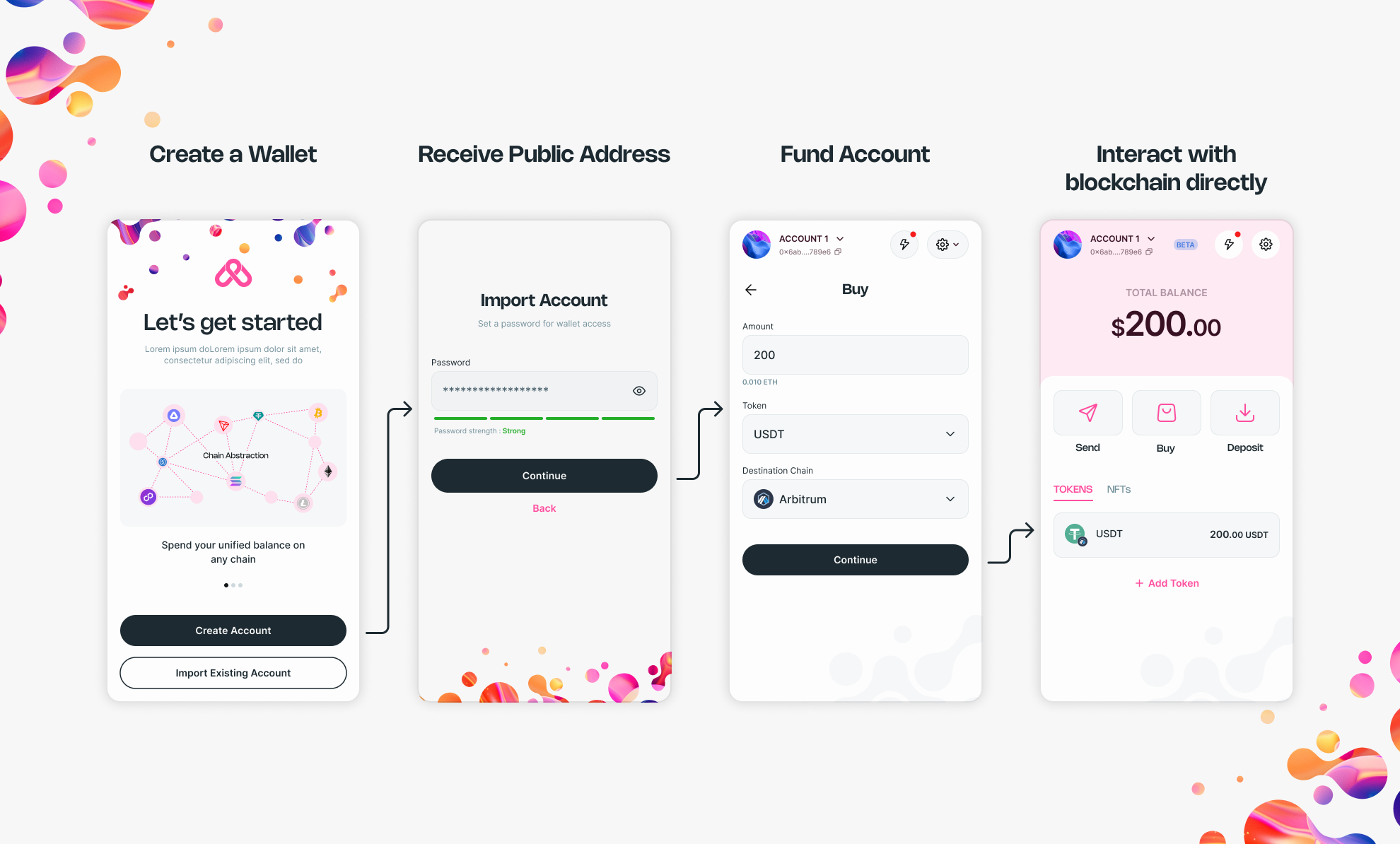

EOAs are the grizzled veterans of the blockchain world. They've been around since the beginning, quietly powering millions of transactions. You probably have one in your pocket right now - that MetaMask wallet? Yep, that's an EOA. Here's what makes EOAs tick:- They're simple: Just a private key controlling a public address.

- They're universal: Want to use multiple chains? No problem

- They're cost-effective: Lower gas fees and no deployment costs.

But EOAs aren't without their critics. Some say they're outdated, a relic of blockchain's past. "Too simple," they cry. "Not programmable enough!"

Yet, for all their supposed flaws, EOAs get the job done. They're the AK-47 of blockchain: reliable, widely compatible, and easy to use. And in the world of chain abstraction, these qualities shouldn't be underestimated.EOA User Flow

- The Challenger: Smart Contract Accounts (SCAs)

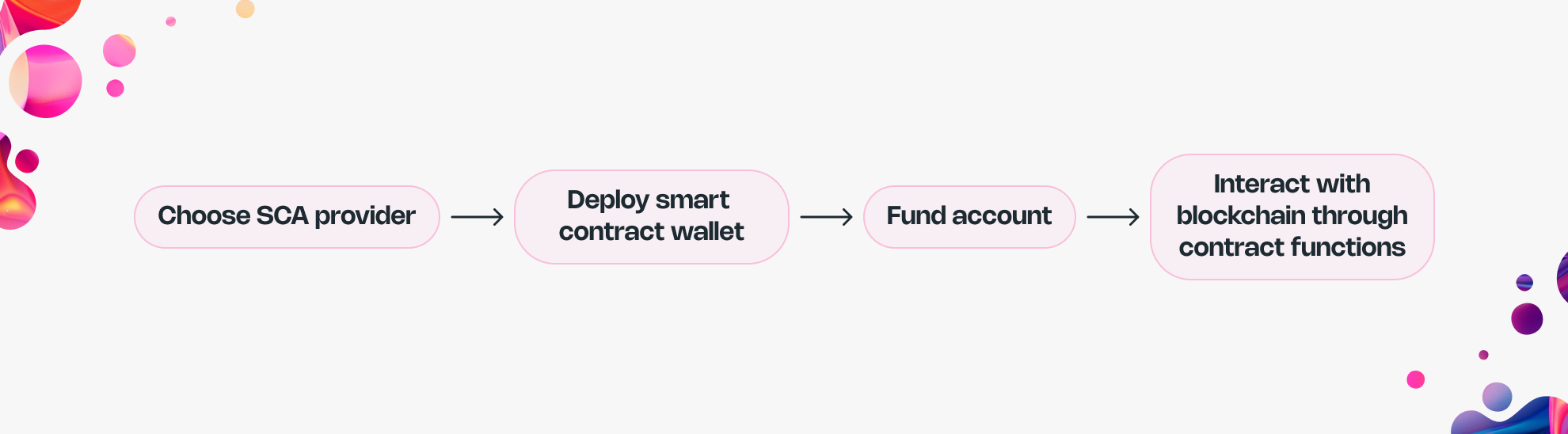

Enter SCAs, the new kids on the block. They strut onto the scene with promises of advanced features and unlimited programmability. "Imagine," they say, "wallets that can enforce spending limits, use time locks, and even create entire economies!"It's an enticing vision, to be sure. SCAs offer:- Complex, programmable behaviors

- Potential for advanced features like resource locks

- Modularity and upgradeability

SCA User Flow

The EOA Narrative: Debunking the Myths

There's a prevailing narrative in some blockchain circles that EOAs are outdated and inadequate for modern needs. However, this view often overlooks several key factors:

- Extensibility: EOAs are more extensible than commonly believed. They can interact with complex smart contracts, participate in DeFi protocols, and even implement advanced cryptographic schemes like threshold signatures.

- Cross-chain Compatibility: EOAs have a significant advantage in cross-chain scenarios. Their simplicity allows for easier integration with non-EVM chains like Solana, making them chain-agnostic.

- Proven Security Model: The security of EOAs is well understood and battle-tested. While not without risks (e.g., private key management), the model has proven robust over years of use in high-stakes scenarios.

- Lower Barriers to Entry: EOAs provide a straightforward onboarding process for new users, which is crucial for the broader adoption of blockchain technology.

In-depth Look at SCA Disadvantages

While SCAs offer intriguing possibilities, they come with significant drawbacks that are often understated:

- High Gas Costs: Deploying and interacting with SCAs typically incurs higher gas fees compared to EOA transactions. For example, a simple transfer from an SCA can cost 2-3 times more gas than an EOA transfer.

- Deployment Complexity: Each SCA needs to be deployed as a separate smart contract, adding complexity and cost to the onboarding process.

- Limited Portability: SCAs are often tied to specific platforms or standards, making it difficult to move assets or interactions across different ecosystems.

- Potential for Bugs: The increased complexity of SCAs introduces more potential points of failure. Smart contract bugs can lead to catastrophic loss of funds, as we've seen in numerous DeFi hacks.

- Vendor Lock-in: Users may become dependent on specific SCA providers, limiting their flexibility and control over their own assets.

- Fragmentation of Assets: App-specific SCAs can scatter user assets across multiple addresses, complicating portfolio management and overall user experience.

SCA Adoption: A Reality Check

Despite the hype, SCA adoption has been slower than many predicted:

- As of 2023, less than 0.1% of active Ethereum addresses were smart contract wallets, according to Dune Analytics.

- Major SCA standards like ERC-4337 have seen limited traction, with only a few projects implementing them in production.

- High gas costs and complex UX remain significant barriers to SCA adoption.

Resource Locks: An important thing to consider

Resource locks are a crucial mechanism in chain abstraction, designed to reduce risks for solvers and improve transaction efficiency. Here's a more detailed look:

- Functionality: Resource locks allow users to temporarily lock funds or assets, guaranteeing their availability for a specific transaction or set of transactions.

- EOA Implementation: With EOAs, resource locks can be implemented through smart contracts that act as escrow services. Users maintain control of their private keys while interacting with these contracts. Example: A lock-and-mint mechanism where assets are locked on the source chain and minted on the destination chain.

- SCA Implementation: SCAs can have resource-locking functionality built directly into the account contract. Example: Rhinestone's account module includes native support for resource locks.

- Comparison:

- EOA approach: More gas-efficient, universally compatible, but potentially less flexible.

- SCA approach: Offers more precise control but comes with higher gas costs and complexity.

- Efficiency: Well-designed EOA-based systems can achieve similar results to SCA implementations, often with lower overhead.

The choice between EOA and SCA for resource locks often comes down to the application's specific needs and the trade-off between flexibility and simplicity.

How about a Hybrid Approach?

The hybrid approach, exemplified by proposals like ERC-7702, attempts to combine the strengths of both EOAs and SCAs. Here's a closer look:

In the Hybrid approach, funds are custodial at the EOA level but can be controlled by an SCA for a specific duration or purpose.

- Potential Benefits:

- Maintains the simplicity and universal compatibility of EOAs.

- Allows for programmable features when needed, similar to SCAs.

- It could provide a smoother transition path for users familiar with EOAs.

- Challenges:

- Complexity in implementation and user experience.

- Potential for increased gas costs during the "SCA-controlled" phase.

- May introduce new security considerations at the intersection of EOA and SCA functionalities.

- Current State: While promising, hybrid approaches are still largely theoretical and require further development and testing before widespread adoption.

While this approach attempts to combine the best of both worlds, We worry it might also combine the worst: the complexity of SCAs with the limitations of EOAs. Sometimes, a simple, well-executed solution is better than a complex compromise.

Future Considerations

As we peer into the future, several factors could shift the balance in this ongoing battle:

- Single Slot Finality: Single Slot Finality is the ability to confirm transactions within a single block. Technological advancements like single-slot finality could reduce the need for complex SCA-based solutions.

- Gas Cost: Continued improvement of rollups and other L2 technologies could reduce gas costs, potentially mitigating some of SCAs' current disadvantages.

- Evolving user needs may drive demand for new features or simplify existing requirements.

- Improvements in SCA technology could address current limitations, making them more viable for widespread adoption.

The Verdict: EOA + Intent Architecture. A Robust Alternative

Combining EOAs with intent-based architectures offers a compelling alternative to SCAs. As the dust settles on our blockchain battlefield, a clear victor emerges - at least for now. The EOA-first approach to chain abstraction stands tall, offering.

- Proven Track Record: EOAs have demonstrated reliability and security over years of use in high-stakes environments.

- Universal Compatibility: EOAs offer seamless integration across different blockchain ecosystems, which is crucial for true chain abstraction.

- Cost-Effectiveness: Lower gas fees and the absence of deployment costs make EOAs more accessible and economical for users.

- Simplicity: The straightforward nature of EOAs aligns well to simplify blockchain interactions for mass adoption.

- Extensibility: Contrary to common perception, EOAs can be extended with advanced functionalities through well-designed smart contract interactions and emerging technologies like MPC and ZKPs.

- User Experience: EOAs' familiarity and simplicity provide a lower barrier to entry for new users, which is crucial for broader blockchain adoption.

- Immediate Viability: While SCAs offer intriguing possibilities, EOAs provide a robust solution that is ready for implementation.

Projects like CoW Protocol and Anoma are exploring this approach, potentially offering SCA-like functionality without the associated drawbacks.

But this victory doesn't mean the end of innovation. SCAs represent an essential frontier of blockchain research and development. Their potential is undeniable, even if their implementation leaves something to be desired.

The key to moving forward is to focus on solving real user problems rather than creating solutions in search of problems. As we push the boundaries of blockchain technology, our north star should continuously be improving user experience and driving adoption.

Ultimately, the chain abstraction showdown between EOAs and SCAs isn't just about technical superiority. It's about creating a future where blockchain interactions are as seamless and user-friendly as possible. And for now, the tried-and-true EOA remains our best path to that future.

The revolution is coming and might be powered by the technology we've had all along.

About Arcana Network

Arcana Network is pioneering a Modular L1 designed to enable Chain Abstractions and intent-based interactions, transforming the Web3 UX. Arcana’s Chain Abstraction solution unifies user balances across multiple chains, allowing seamless spending without bridging. This approach tackles liquidity fragmentation prevalent with the rise of numerous L1s, L2s, and L3s.

Arcana has raised $4.5M from 40+ leading investors including Balaji S, Founders of Polygon, John Lilic, Santiago Roel, and funds like Woodstock, Republic, Fenbushi, Polygon Ventures, DCG, and others. Our native token $XAR is listed on Bybit, Gate, and MEXC.

Discover the Power of Chain Abstraction

Want to dive deeper into how chain abstraction can simplify your blockchain projects? Visit our Abstracted Academy and unlock the potential of seamless interoperability across chains.