Top 5 Hop protocol Alternatives for 2025

The blockchain space is evolving faster than ever, and cross-chain bridging has become more crucial for seamless operations in the crypto world. Hop has been a go-to solution for many developers and startups, but as technology advances, new alternatives are emerging that promise even better performance and additional features. This post explores the best five Hop alternatives you should consider in 2024 to meet your cross-chain bridging needs.

Why Cross-Chain Bridging is Key

Cross-chain bridging is essential because it allows different blockchain networks to communicate and interact with each other. This interoperability is crucial for maximizing the utility and flexibility of blockchain technology. Hop has been a popular choice in this space, but as user needs evolve and new blockchains emerge, it’s wise to explore other options that might offer better security, speed, and user experience.

Criteria for Choosing Alternatives

Before we jump into the alternatives, let's discuss the criteria for selecting a cross-chain bridge. Here are some key factors to consider:

- Security: The bridge must have robust security measures to protect your assets from hacks and vulnerabilities.

- Speed: Faster transaction speeds can significantly improve user experience.

- Supported Chains: The more chains a bridge supports, the more versatile it is.

- Fees: Lower fees ensure cost-effective transactions.

- User Experience (UX): A seamless and intuitive user interface can make a big difference in ease of use.

For 2024, compatibility with emerging blockchains and advanced security features are particularly crucial.

1. Arcana.network

Arcana Network offers a modular Layer 1 protocol designed to simplify chain abstraction. It aims to eliminate liquidity and user fragmentation, providing a universally smooth multi-chain experience.

Key Features

- Universal Asset Holding: Hold assets across multiple chains and view a unified balance.

- Gas Fee Abstraction: Removes the friction of gas fees, making transactions smoother.

- Wallet Address Abstraction: Send crypto to any user with just their email ID.

Pros and Cons

Pros

- High Security: Strong focus on security measures to protect user assets.

- User-Friendly: Easy onboarding with email or social login.

- No Bridging Required: Spend a unified balance on any chain without the need for bridging.

Cons

- Limited Current Adoption: Still gaining traction compared to more established options.

- Emerging Technology: Some features are still being rolled out, so full functionality may not be immediately available.

Arcana Network stands out as a solid choice for 2024 due to its comprehensive approach to chain abstraction and user-friendly features. The elimination of bridging needs and gas fee abstraction make it an excellent option for startups looking to simplify their blockchain interactions.

2. EverBridge

EverBridge integrates blockchains to allow seamless movement between networks. It is available on Ethereum and Binance Smart Chain and aims to create a consistent supply across multiple blockchains.

Key Features

- Multi-Chain Integration: Connects tokens to multiple blockchains.

- Unified Supply: Maintains a consistent token supply across all chains.

- Bridge Vault: Locks and unlocks tokens to ensure secure transfers.

Pros and Cons

Pros

- Versatile: Supports multiple blockchains.

- Security: Uses bridge vaults to secure tokens during transfers.

- Scalable: Suitable for both small and large-scale operations.

Cons

- Complex Setup: Initial setup can be complicated.

- Limited User Interface: The UI is functional but not the most user-friendly.

EverBridge is a robust option for enterprises looking for secure and scalable cross-chain solutions. Its ability to maintain a unified supply across multiple chains makes it particularly appealing for projects involving tokenomics.

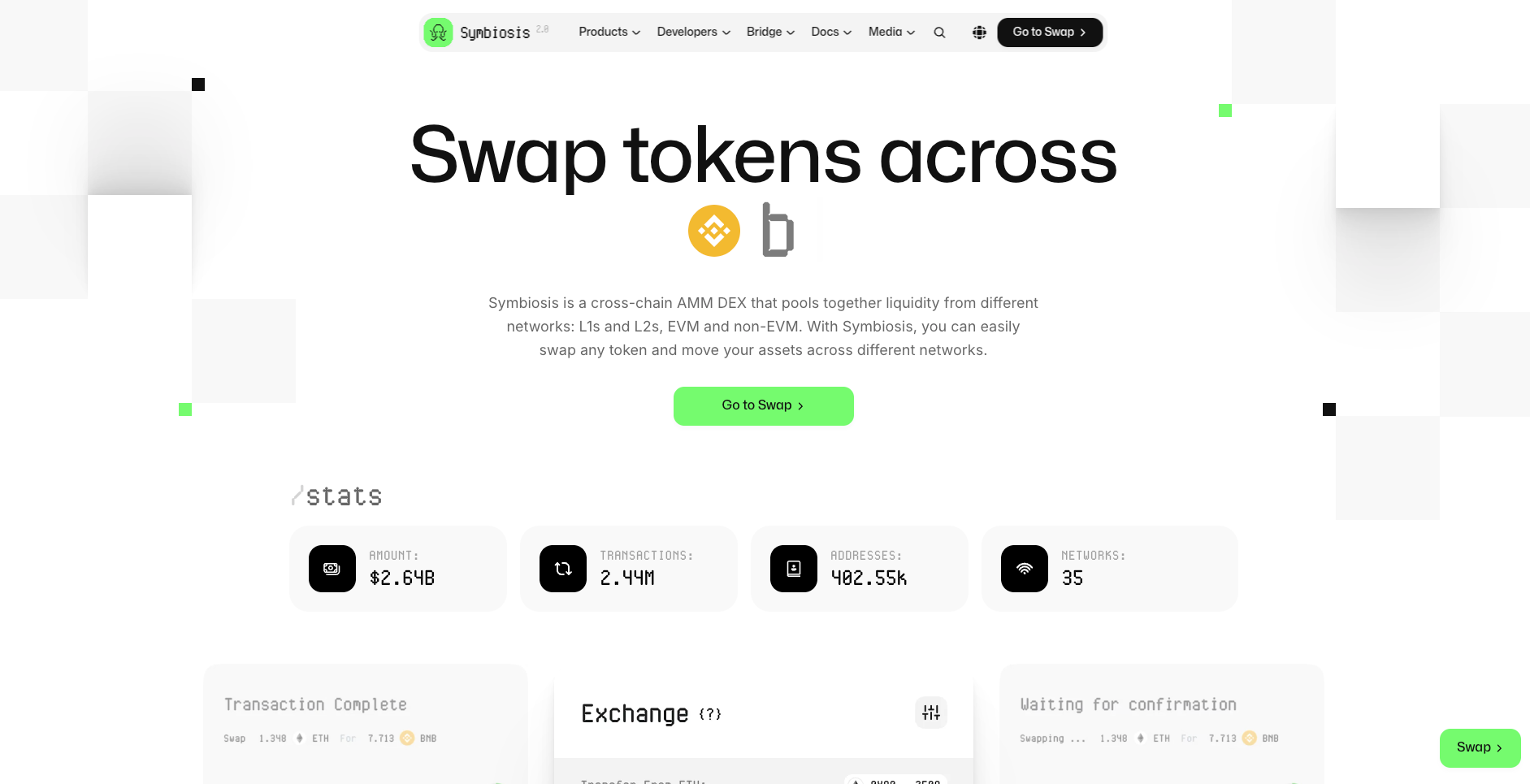

3. Symbiosis Finance

Symbiosis Finance is a decentralized multi-chain liquidity protocol that allows users to exchange tokens between all chains while remaining the sole owner of their funds.

Key Features

- Fully Decentralized: No central authority controls the funds.

- Uniswap-like UX: Simple and intuitive user experience.

- Non-Custodial: Users retain full control over their assets.

Pros and Cons

Pros

- Easy to Use: Simple interface similar to Uniswap.

- Secure: Non-custodial design enhances security.

- Market Attention: Connects any chain that receives significant market attention.

Cons

- Limited Token Pairs: Still expanding its range of supported token pairs.

- Network Fees: Can be higher depending on the network's congestion.

Symbiosis Finance is an excellent choice for those looking for a decentralized and user-friendly solution. Its non-custodial nature ensures that users maintain full control over their funds, making it a trustworthy option for 2024.

4. Aave Protocol

Aave is an open-source, non-custodial liquidity protocol that allows users to earn interest on deposits and borrow assets. It operates in a decentralized manner, providing a secure and transparent platform for financial activities.

Key Features

- Interest on Deposits: Earn passive income by providing liquidity.

- Borrowing Options: Borrow assets in both overcollateralized and undercollateralized fashions.

- Security Audits: Regularly audited by top security firms.

Pros and Cons

Pros

- Highly Secure: Multiple security audits ensure a safe environment.

- Flexible Borrowing: Various borrowing options to suit different needs.

- Community-Driven: Open-source nature allows for community input and improvements.

Cons

- Complex Interface: May be challenging for beginners.

- High Collateral Requirements: Borrowing often requires significant collateral.

Aave stands out for its secure and flexible financial services. It’s an excellent option for businesses looking to leverage liquidity protocols for both earning and borrowing, making it a comprehensive alternative to Hop.

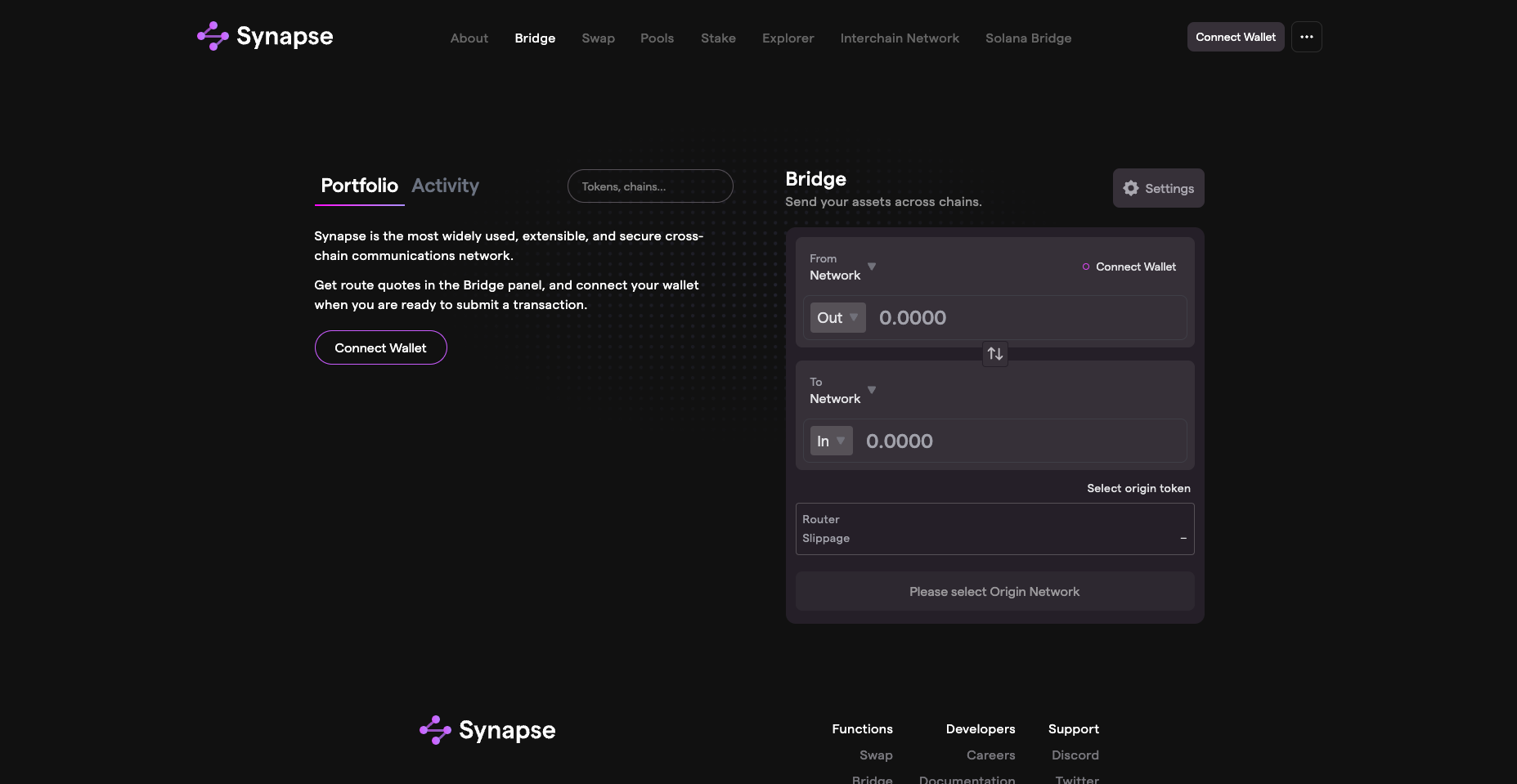

5. Synapse Protocol

Synapse Protocol enables the transfer and swapping of assets across various blockchains, including Ethereum, Layer 2 Chains, BSC, and Avalanche.

Key Features

- Cross-Chain Transfers: Seamlessly move assets between different blockchains.

- Low Slippage: Efficient trading with minimal slippage.

- Liquidity Incentives: Earn liquidity incentives and transaction fees.

Pros and Cons

Pros

- Efficient Swaps: Low slippage ensures cost-effective trading.

- Highly Liquid: Large liquidity pools for various assets.

- Security: Proven smart contracts secure funds.

Cons

- Network Fees: Transaction fees can vary based on network conditions.

- Complexity: May require a learning curve for new users.

Synapse Protocol offers a highly liquid and efficient cross-chain swapping experience. Its low slippage and robust security features make it a compelling choice for 2024.